Car allowance tax calculator

CAR TAX CALCULATOR 1. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser.

2022 Car Allowance Policy Calculate The Right Amount

Uber in Whitingham VT When you look up the fare estimates for Uber in Whitingham Windham Vermont United States - it looks fairly familiar.

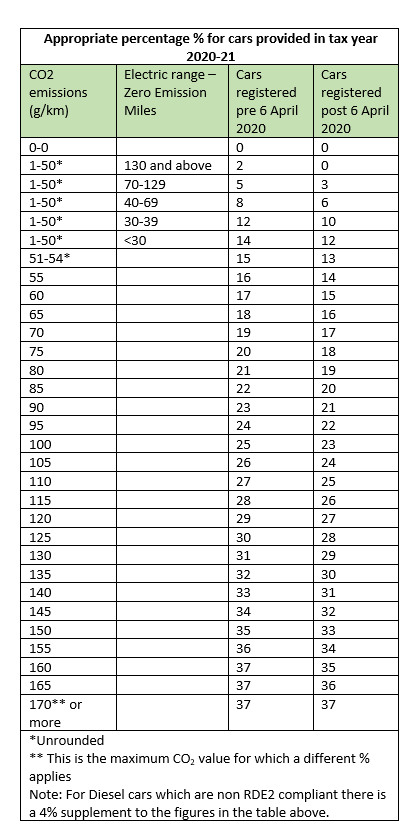

. Tick if Yes Taxable Transport Allowance. Taxability of Motor Car Perquisite. Car tax rates are based on fuel type and CO 2.

Whether the assessee is handicapped. Information relates to the law prevailing in the year of. Tax Calculator in Whitingham VT.

Whitingham is located within Windham. Notice of Tax Sale 102721. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you.

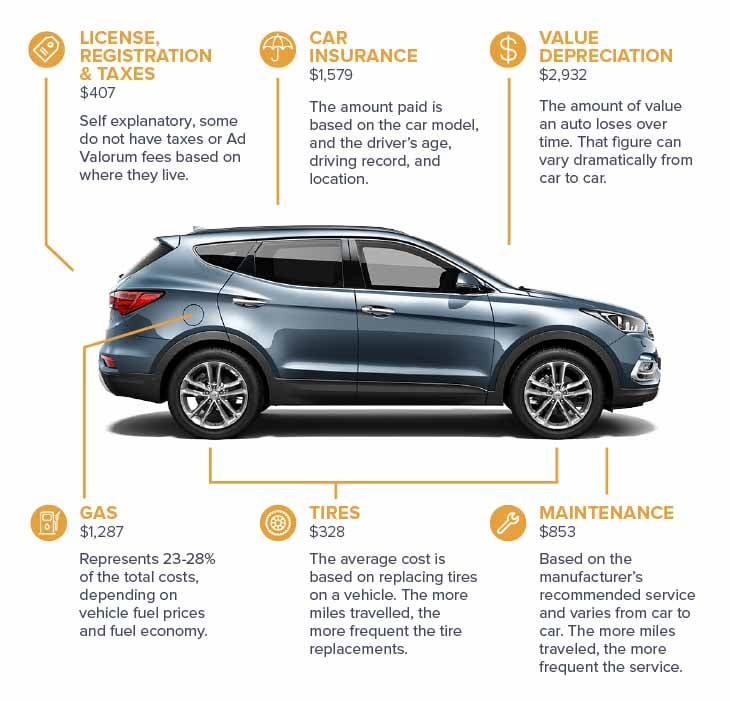

There is a base fare a charge per mile and a. Use a tool like FuelEconomy to calculate fuel costs. This means your Personal Allowance of 12750 will first be deducted before taxes are applied.

Heres a step-by-step process to make calculating your car allowance easier so that its not time-consuming or a hassle to do. Tax payments 3. The Whitingham Delinquent Tax Collector has posted a notice of tax sale to be held on October 27th at 930am.

Name A - Z Sponsored Links. Income Tax Department Tax Tools MotorCar Calculator. Super contribution caps 2021 - 2022 -.

Your results You can use this service to calculate tax rates for new unregistered cars. Work-related car expenses calculator. You can calculate taxable value using commercial payroll software.

It can be used for the 201314 to. 2022 Car Allowance Calculator. 2023 Car Allowance Calculator.

Select the nature of. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514. The average cumulative sales tax rate in Whitingham Vermont is 6.

Tax rates 2021-22 calculator. And that too at a rate of 20 per cent on the amount in excess of 12750. Current 01 March 2022 - 28 February 2023.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. This includes the sales tax rates on the state county city and special levels. Tax rates 2022-23 calculator.

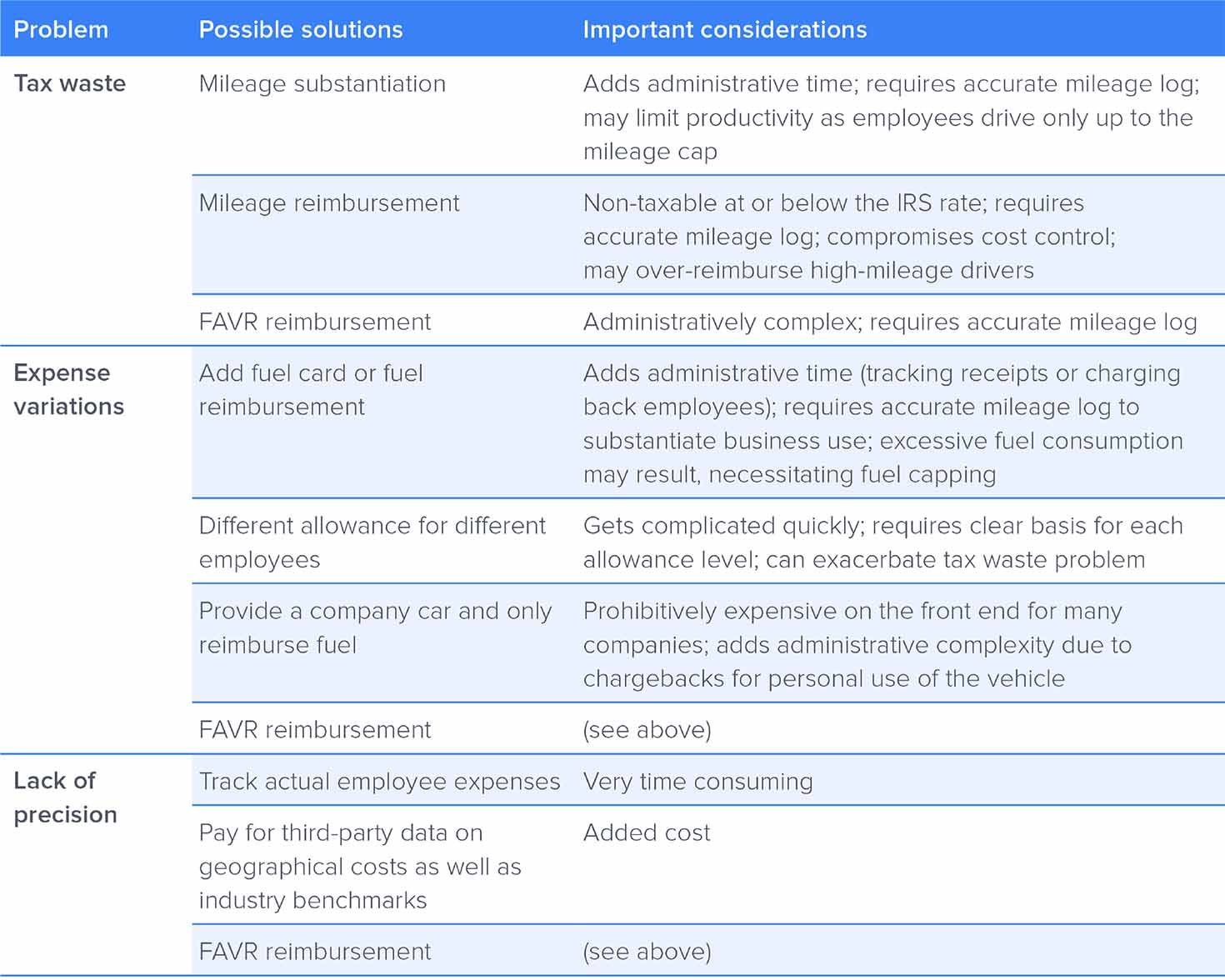

Payment of a car allowance gives rise to a number of tax questions. Taxability of other than Car Perquisite. See official notice attached below.

01 March 2021 - 28 February 2022. As amended upto Finance Act 2022.

2022 Everything You Need To Know About Car Allowances

Florida Vehicle Sales Tax Fees Calculator

How To Get A Tax Benefit For Buying A New Car Axis Bank

Travel Allowance Or Company Car Which Is Better Contador Accountants

2022 Everything You Need To Know About Car Allowances

What Is The Average Car Allowance For Executives I T E Policy I

Should You Take A Company Car Or A Car Allowance

A Guide To Company Car Tax For Electric Cars Clm

Car Benefits Data Input Calculation 2020 21 Moneysoft

Doordash Taxes 19 Faqs Car Mileage Expenses For Dashers

2022 Everything You Need To Know About Car Allowances

Allowance Vs Cent Per Mile Reimbursement Which Is Better

Is Car Allowance Taxable Under Irs Rules I T E Policy I

Company Car Or Car Allowance What Do I Choose Youtube

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

2022 Car Allowance Policy Calculate The Right Amount